This is a free episode, available to everyone. To be able to read and comment on all episodes, plus access the full archive, please consider becoming a paid subscriber for as little as $1/month or $10/year:

Note: Everything in this post is my personal opinion. If you don’t agree, set up your own Substack. Or, leave me a comment.

It seems to me that one of the problems many folks have understanding our current budget is that there are huge differences between million, billion and trillion.

You can say, “a billion is a thousand millions and a trillion is a thousand billions.”, but I don’t think that really gives a real sense of the scale differences.

Here’s an example I saw somewhere1 that gives a real-world sense of the scale difference:

1 million seconds is about 11.5 days.

1 billion seconds about 31 years and 8 months.

1 trillion seconds is about 31,688 years.

That said, here’s the column. Sorry for the length, I have a lot to say recently:2

H.R. 1, named the “One Big Beautiful Bill Act” by our idiot illustrious3 President, was narrowly passed (by one vote) by the US House of Representatives on party lines. That means every Republican Representative was the deciding vote.

See the end of this article if you want to let them know how you feel about that.

There are many, many, many defects in this bill, but today I’m writing about the extension of the 2017 “Tax Cuts and Jobs Act”, which cut taxes primarily for the top 1% of earners in this country.

The Republican Party has an obsession with trying to increase revenue by cutting taxes, mostly for the folks that make lots & lots of money and cutting “wasteful” Federal spending.

As near as I can tell, reducing the top marginal tax rate has succeeded in increasing revenues twice4:

During the Harding administration in 1921 the top marginal tax rate was reduced from 73% in 1921 to 25%. Federal tax revenues increased from $719 million in 1921 to over $1.1 billion in 1929, a 61% increase during a period of zero inflation. The economy expanded by 59% between 1921 and 19295.

During the Kennedy administration the Revenue Act of 1964 reduced the top marginal tax rate from 91% to 70%. Following the tax cuts, the economy experienced robust growth, and tax revenues increased. The tax cuts are credited with stimulating economic expansion during that period.

Note that in both cases the top rate was decreased from a very high percentage to a lower percentage6. Harding’s tax cut was more extreme than Kennedy’s, from 73% to 25%. However, Kennedy’s cut from a ridiculous 91% to 70% both stimulated the economy and kept tax revenues high, a win-win.

This led to a stock market boom that lasted the better part of a decade.

I suspect the Kennedy tax cut led fiscal conservatives to decide that Tax Cuts Always Improve the Economy.7

However, every time they’ve tried to put this into effect since then it has failed miserably, e.g.:

The Reagan tax cut in 1981 reduced the top marginal tax rate from 70% to 50%, and further to 28% by 1986. The loss of Federal revenue contributed to higher deficit spending in the 1980s, arguably starting the nation on the road to the extremely high deficit spending and national debt we’re seeing today.

In 1990, because of deficit spending and growing debt caused by the Reagan tax cut, George H. W. Bush was forced to increase tax rates in spite of his “Read my lips, no new taxes!” campaign promise.

In 1992 Bill Clinton was elected, partly because of a campaign slogan, “It’s the economy, stupid!” 8 years later the Clinton administration left the George W. Bush administration a budget surplus

The Bush II administration cut the top marginal tax rate in the early 2000s from 36.9% to 35%8. Eight years later, due to reduced revenues, deficit spending, deregulation of Wall Street investors, banks, real estate loans, and general mismanagement of the economy the GWB administration left the Obama administration with the biggest economic recession since the Great Depression of the 1930s.

Between 2009 and 2017, under the Obama administration the recession eased, allowing President Obama to present the first Trump administration with an economy that was purring along with low inflation, low unemployment and low interest rates.

Trump did everything he could to mess up the Obama economy, including passing the budget-busting 2017 “Tax Cuts and Jobs Act” which cut the tax rates for the middle class by between 3% and 4% and cut the top marginal rate by 2.6%.9 This seems fair, except that if you made $100,000 you’d save about $4,00010 on your taxes, but if you made $10,000,000 your tax savings would be more like $360,000.11

I’ve written about this before.

There are other personal tax cuts, such as doubling the tax-free estate limit from $5.6 million to 11.2 million. There’s a lot to unpack. The Wikipedia article covers all the ins and outs.

These personal tax cuts are due to expire at the end of 2025.

The top corporate tax rate was reduced from 39% to 21%, so if you owned a company that made a $1 billion dollar profit you’d save $180 million. Not too shabby.12 Most of the corporate TCJA tax reductions are permanent.

In any case, if Trump had been able to coast along on the Obama economy everyone would have thought he was a genius and he probably would have won a second term in 2000. COVID, and his shambolic and disastrous response to it messed that up for him.

In 2001 Joe Biden took over the Presidency and, in my opinion, skillfully guided an economy that had been shut down for over a year back to being “the envy of the world”.

At the time I remember reading lots of columnists opining that there was no way to bring the economy in to a “soft landing”. The world had never completely shut down it’s economy and then restarted it before.

Runaway inflation followed by a deep recession was predicted.

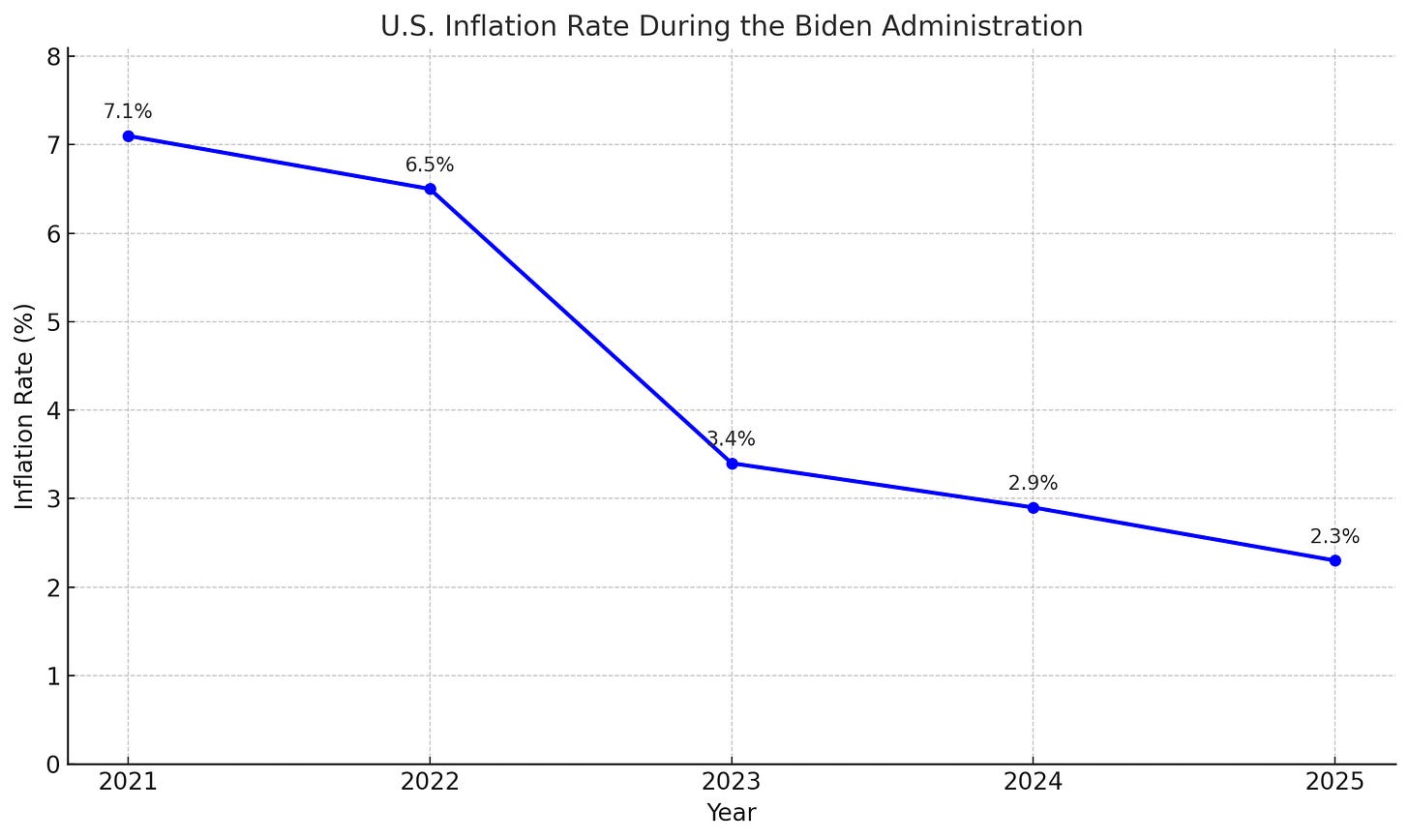

Due to supply chain issues and stimulus spending inflation did spike to around 9%, but rapidly came back down to about 2.3%, close to the 2% target of the Fed.

Here’s a chart I generated in ChatGPT using data from Investopedia, US Inflation Calculator, and Trading Economics

At the end of the Biden administration:

Wages were up, especially at the low end of the scale.

Inflation was down.

Unemployment was down.

Things were looking good.

So why did about half of the electorate vote for Donald Trump? I think it’s because very few people have the time or inclination to follow politics and economic news as closely as you13 and I.

I’m old enough to remember double-digit inflation a few decades ago, but most folks in the country are a lot younger than I am and don’t understand how inflation works.

Once prices go up, they mostly don’t come back down.

Folks who didn’t live through the 70s and 80s don’t know this, and Trump took advantage of that and promised to bring down prices “on day one”.14

At the end of the Biden administration wages were rising faster than inflation, especially at the lower end of the wage scale.

But folks wanted prices to go back to where they had been. I suspect this, more than anything else is what allowed a convicted felon to be elected to the Presidency for the first time in US history.

Which brings us to now. Donald Trump could not bring prices back down “on day one.”

Instead he’s instituted ridiculously high tariffs on every country in the world except Russia.15

Tariffs are nothing more than a sales tax on consumers.

They are inflationary and regressive, they affect low wage households way more than households with higher incomes.

It’s been about four months since he took office and prices are starting to go up, not down.

He’s also in the process of destroying the credibility of the US around the world.

In case I’m being to subtle here, my thesis is that, since around 1980 (at least) Republican administrations have completely f***ed things up and Democrats have had to come in and clean up their messes.

I’m neither a Democrat or a Republican, but given the direction the GOP seems to want to take this country I’ll be voting for Democrats unless and until a viable third option comes along.16

In almost every case that a Republican administration has tried to stimulate the economy by cutting tax rates for the multi-millionaire/billionaire class, while also cutting funding for “safety net” programs such as “welfare”, food stamps, Medicaid, etc. there was an expectation that lower taxes would lead to higher investments in businesses resulting in higher wages, higher profits and a combination of reduced cost to the federal government and increased revenue from the tax base.

Turns out, not so much.

Instead of investing in research and development, higher wages, better benefits, etc. most companies either banked their tax savings, paid them out to shareholders as dividends or used the money in stock buy-backs to artificially boost their stock price.

I was working at Disneyland at the time. Instead of bumping up our hourly wage the company gave every employee a one-time $1,000 bonus. That’s less than 1/2 month’s rent in southern California.17

Now the GOP is trying to pass H.R. 1, the “One Big Beautiful Bill” Act.

As I mentioned earlier, it passed by one vote in the House and is now being considered by the Senate.

Among other things it would make the TCJA personal income tax cuts permanent.

This will blow a multi-trillion dollar hole in the Federal budget over the next 10 years.

The whole point of the Department18 of Government Efficiency was to find a couple of trillion dollars of “waste, fraud and abuse” in the Federal bureaucracy and eliminate it, to pay for the exorbitant tax cuts the GOP wants to ram down our throats.

The problem is that there really isn’t that much WFA in our government.

So the only way to save enough money to pay for these continued tax cuts for the super rich is to start eliminating programs entirely.19

Unfortunately, Elon Musk and Russell Vought20 aren’t interested in cutting back on big-budget items like defense spending21 , they’d rather eliminate or cripple safety net programs such as Medicaid, SNAP (food stamps), Meals on Wheels, etc.

They also have Medicare and Social Security in their sights.

They don’t like the Corporation for Public Media (NPR and PBS) because those organizations try to truthfully report the things politicians say and do, which the some politicians consider to be leftist propaganda.22

Nor do they like programs like USAID that help save the lives and health of black and brown people in “s**thole countries” they don’t care about.

And for some reason they have it out for scientists doing research into the climate23 , health24 or anything else.

Unfortunately the amount of money that can be saved by limiting or eliminating these programs is measured in a few millions or billions, not the trillions needed to fund these unnecessary and extremely expensive tax cuts.25

Everyone wants to make sure their tax money is spent wisely, but taking an axe or a chainsaw to programs that millions of people depend on isn’t the way to do it.

The way they’ve been doing it isn’t even legal. They’re refusing to spend money that was appropriated by Congress, which isn’t one of the Article II powers given to the Executive branch.

One of the first things the Trump administration did was (illegally) fire a bunch of Inspectors General. These are the folks that are tasked with making sure the government is running as efficiently as possible.

If one of IGs isn’t doing their job there are procedures to get them removed through Congressional action, but a President can’t just pick up the phone (or type a “Truth” on his personal social media site) and fire them.

The House and Senate are currently both under the control of the Republican party, which seems to be completely under the thumb of our current Convict in Chief.

What can you do about this?

If you disagree (or agree) with anything your elected Federal Officials are doing, please let them know.

Check https://www.congress.gov/members/find-your-member to find out who your Senators and House Representative are.

You can also leave comments on their websites.26

You can call your federal representatives (Congressperson and both Senators) at (202) 224-3121.

Or you can go to the 5 Calls site (https://5calls.org/) or use the 5 Calls app27 (Android) (iPhone) to choose a topic and call your House rep and both Senators. 5 Calls even provides you with a script.

If you want to join the growing number of us that are peacefully demonstrating against the actions of this administration, go to https://www.mobilize.org/ to find local rallies and demonstrations you can participate in.

From where I’m sitting this country is in deep trouble, sliding closer to an authoritarian regime every day. I say it’s time we did something about it.

Musical Coda:

This is a live medley of “Son of Orange County” about Richard Nixon and “More Trouble Every Day” about riots in the 60s by Frank Zappa and The Mothers of Invention.

With some minor lyric changes they’re still valid today.

If you want to support my efforts and be able to comment, plus have access to the archives you can start a paid subscription at any of the following levels.

Anything helps.

$1 a month or $10 per year or $2 a month or $20 per year or $3 a month or $30 per year or $4 a month or $40 per year or $5 a month or $50 per year.

Or, if you’re rolling in the dough, become a founding member for $150/year by clicking this link and choosing “Founding Member”.

Or send me a one-time donation of a dollar (or more) to SeniorGeek49 on Venmo, or scan this QR code to donate via Zelle:

You can find me at any one of these places:

Substacks I highly recommend:

If I ever figure out where I’ll add a link.

This one took a while to write, sorry for the delay.

I have other words to describe him, but I’m feeling generous right now.

I asked ChatGPT “Has cutting the top marginal tax rate ever improved revenues?” I then checked other sources to confirm that ChatGPT wasn’t hallucinating. It’s getting better.

Of course, we all know what happened in October of 1929.

The economy was booming with a top rate of 70%. If the TCJA is allowed to expire the top tax rate with be 39.6%. Seems to me that if we can have a booming economy with a 70% rate on the super rich, it should be even better at 39.6%.

That’s what you get when you reason from one or two data points.

To be fair, the Bush II tax cuts had sunset dates, and were extended under the Obama administration for people earning less than $400,000 per year.

See the tax tables in this article.

It’s more complicated than that, but I’m trying to keep things simple here.

Which, if you’re making $10 million/year you should be able to afford. In my opinion.

Again, it’s more complicated than this, but these figures are in the ballpark.

I’m assuming. I mean you’re still reading this article, right?

Easy to say. In practice, not possible to do.

Why that one country? I have a feeling I know why…

Ranked choice voting anyone?

To add insult to injury, my union was in contract negotiations at the time and the company held the bonus hostage to union member approval of the contract.

Not a Department

To the current version of the GOP this is a feature, not a bug. These folks want to drastically decrease the size of the Federal Government. One of their strategies is to take on so much debt that popular services and departments will be forced to shut down because there won’t be enough revenue to service the debt and also fund things like National Parks, Medicaid, subsidies for the Affordable Care Act, public radio and TV, foreign aid and even Medicare and Social Security.

Chief architect of Project 2025

Especially Musk who’s making bank on government contracts

My daughter likes to say, “The truth has a liberal bias.”

“Climate change is a hoax”

“Vaccines cause autism”

Go back to the top and read my blathering on the difference between millions, billions and trillions.

Pro tip, if you ask for an email response to a comment made on a Congressional web site, you can reply to or write a new email to the Congressperson’s From: address. This gets around character limits on web comment forms.

Look for it in your phone’s app store.