This is a free episode, available to everyone. To be able to read and comment on all episodes, plus access the full archive, please consider becoming a paid subscriber for as little as $1/month or $10/year:

Note: Everything in this post is my personal opinion. If you don’t agree, set up your own Substack. Or, leave me a comment.

in response to my bonus column last week I received an email from someone who may or may not be an old friend His name is fairly common, so it may be someone else.

I’ll call him Bob1 because that’s his name. I want to thank him because I wasn’t sure what I was going to write about this week.

Here’s Bob’s complete, unedited text:

The left always says their fair share but never defines what that is. The only way to get everyone to pay their fair share is a flat tax with know deductions. 2022 figures show around 40% of the working paid no tax how about their fair share.

Let’s start with the first sentence.

“The Left” has put forward all kinds of ideas on how to level the playing field when it comes to taxes.

During her presidential campaign Elizabeth Warren suggested a Wealth Tax on family net worth of over $50 million. I’m not saying this is a good or bad plan, but it is a plan that was suggested by a left-leaning Senator:

Zero additional tax on any household with a net worth of less than $50 million (99.9% of American households)

2% annual tax on household net worth between $50 million and $1 billion

4% annual Billionaire Surtax (6% tax overall) on household net worth above $1 billion

10-Year revenue total of $3.75 trillion

For example, under current rules if your family’s ordinary income was exactly $50 million and you took the standard deduction you’d pay ≈ $18.42 million in taxes, or about 36.83%. At the end you’d still have about $31.58 million for walking around money.2

I’m assuming ordinary income and the standard deduction to keep things simple.

Now assume you are a family with ordinary income of exactly $1 billion.

You’d pay ≈ $369 million or about 36.9% and have $639 million to help you squeak through the year.

Finally, assume Senator Warren’s wealth tax was in effect and you made $1 billion in ordinary income. The tax on your first $50 million would not change. You’d pay 2% on the remaining $950 million or an extra $19 million, reducing your yearly income to just above the poverty line3 at $620 million.4

And that’s just one idea.

Bernie Sanders has a plan.

AOC has a plan.

Check any random progressive politician’s web site and I’ll bet you’ll find some kind of tax plan.

In general Progressives and Liberals like progressive taxation that tries to level the playing field by taking individual’s ability to pay into account. So much for the first sentence in Bob’s email.

He goes on to suggest a flat tax with no deductions as a solution to funding our government. There was a time in my life that I agreed with him on this.

The problem with a flat tax is that it’s a regressive tax. It affects the working poor way more than it does the middle class and high earners.

And the gap between the working poor and the super rich has been widening rapidly over the past couple of decades.

I’ll use my state as an example. In California the minimum wage is $16.50.

Southern California is an expensive place to live. Rent for a two bedroom apartment ranges from around $2,500 to $3,500 in my area.

Much to my surprise, according to Zillow the unexceptional 1800 sq. ft. four bedroom, three bath house my wife, daughter and I have shared for almost three decades is worth over $1 million.

Try saving a down payment for a million dollar house if you’re in a minimum wage job.

If you work full time at minimum wage you make $2,860/month pre-tax, about $2,544/month after taxes.

This means a minimum wage worker working full time in this area can’t live anywhere near his or her workplace because their entire paycheck would be eaten up by rent.

So the folks who do our gardening, fix our cars, work in restaurants, hotels, car washes, etc. either have to commute long distances from areas with cheaper rents, or jam way more people into a house or apartment than it was designed to house.

And still they need to work more than one job, just to pay the bills. This makes it really hard to spend any time with their kids. Neglected children don’t do well in school and tend to have difficulties during their teens and twenties, especially the boys.

It also makes it impossible to save for a house or go to school or training to increase skills.

It’s a vicious circle.

Lets get back to a flat tax, no deductions.

Last year it cost about 6.75 trillion to fund the US Federal Government.5

About 153.6 million tax returns were filed.

This would require every person or family who filed a return to pay about $44,000 in taxes.6

Working full time at the California minimum wage you would make $16.50 * 40 * 52 = $34,320, almost $10,000 less than your tax bill. Even with two jobs it would be nearly impossible to pay taxes, rent and buy food.

That’s ridiculous.

Let’s take it the other way. Say there was a 10% flat tax, no deductions.

Last year’s total reported Adjusted Gross Income was $14.7 trillion.

Let’s multiply that by, say, 135%7 to try to get close to the actual earned income, $14.7 * 1.35 = $19.845 trillion, meaning a 10% flat tax would generate about $1.9 trillion, less than 1/3 of the $6.75 trillion budget.8

A 35% flat tax might do it. But that’s close to the top income tax rate today and my understanding is that a flat tax would result in most folks paying much less.

The example family making $50 million would pay $17.5 million in taxes, leaving them $32 million to squeak by on.

However, the family trying to live on $34,320 would have to pay $12,012 in taxes, leaving them only $22,308 to live on, which is impossible anywhere in Southern California.9

Maybe we can shrink the federal government to less than 1/3 its current size?

As Elon Musk’s DOGE kids found out, there is nowhere near as much Waste, Fraud and Abuse in our government as they thought.10

The only way to shrink the government that much would be to completely eliminate the US military and drastically cut popular services such as Social Security, Medicare, Medicaid, the Affordable Care Act, National Parks, Interstate Highways, Air Traffic Control, and on and on.

I’m very much in favor off finding and eliminating waste, fraud, abuse and corruption in local, state and the federal government. But there are better ways (actual legal ways) to do this without taking a chainsaw to Congressionally approved government agencies.

And I haven’t taken state and local taxes into account.

Sales taxes, federal and state gas taxes, property taxes (indirectly, through rent increases), etc. are regressive, they affect low wage workers more than the wealthy.

The same goes for tariffs, which are effectively sales taxes.

Bob’s final point was that there are 40% of our population who pay no taxes. According to this site the percentage of the working poor who don’t owe taxes under current rules is more like 31%.

These are the poorest of the poor. The vast majority of them are the opposite of lazy.11 They are human beings and should be treated with respect.

They contribute to our country by washing our dishes, mowing our lawns12, building our houses, harvesting our crops, fixing our cars, building and fixing our roads, and on and on.

These are the hardest working people in our country. And yet the organizations they work for don’t value their labor enough to pay them a living wage.

On the other hand, multi-millionaires and billionaires may “work hard” in office jobs, but they are making their much of their money through investments. I doubt there are too many of them digging ditches.

Capital gains require no actual physical work, yet are taxed at a lower rate than regular income. This seems backwards to me.

Yes, there is risk involved in investing, but I doubt if anyone who loses millions in the market has to worry about where their next meal is coming from or where they will sleep that night.

I am all for talented people being paid what they are worth.

But they need lots and lots of folks to work for them to make their visions into reality.

The skills and labor of those individuals has value, and the way things are now, most of the folks doing the actual useful work are not being paid according to the value of their contribution.

I think those who have benefitted by the labor of others, and who are using roads, railways, airports, bridges and other infrastructure built by the working class and paid for by the government should pay more taxes than those that can barely make ends meet even when working multiple jobs and sharing living quarters.

But maybe that’s just me.

For my next column I’m planning on writing about the One Big Beautiful Bill Act that just passed in the House. Stay tuned.

Musical coda:

Thank you for reading Diary of a Senior Geek. This post is public so feel free to share it.

If you want to support my efforts and be able to comment, plus have access to the archives you can start a paid subscription at any of the following levels.

Anything helps.

$1 a month or $10 per year or $2 a month or $20 per year or $3 a month or $30 per year or $4 a month or $40 per year or $5 a month or $50 per year.

Or, if you’re rolling in the dough, become a founding member for $150/year by clicking this link and choosing “Founding Member”.

Or send me a one-time donation of a dollar (or more) to SeniorGeek49 on Venmo, or scan this QR code to donate via Zelle:

You can find me at any one of these places:

Substacks I highly recommend:

Lots of Bobs out there.

This is assuming Chat GPT is calculating correctly from the prompt “If my family’s income was $50,000,000 about how much would I pay in US federal income tax?” For simplicity the assumptions were joint filers, 100% ordinary income, standard deduction.

I used ChatPT for all of the tax calculations in this column because, and I want to stress this, I am not an accountant. Nor do I play one on TV.

No extra charge for sarcasm!

You may want to check my math on this, but it’s close.

Maybe you think that’s way too much, but bear with me here.

$6,750,000,000,000 / $153,600,000 = $43,945.3125

Dad called this a SWAG, Scientific Wild-Ass Guess

Since I’m guessing about the difference between gross income and adjusted gross income this number may be off by an order of magnitude. But the point stands.

Or probably anywhere else in the US unless you’re getting some kind of government help, Medicaid, SNAP, etc.

I could have told them that, but they didn’t ask me.

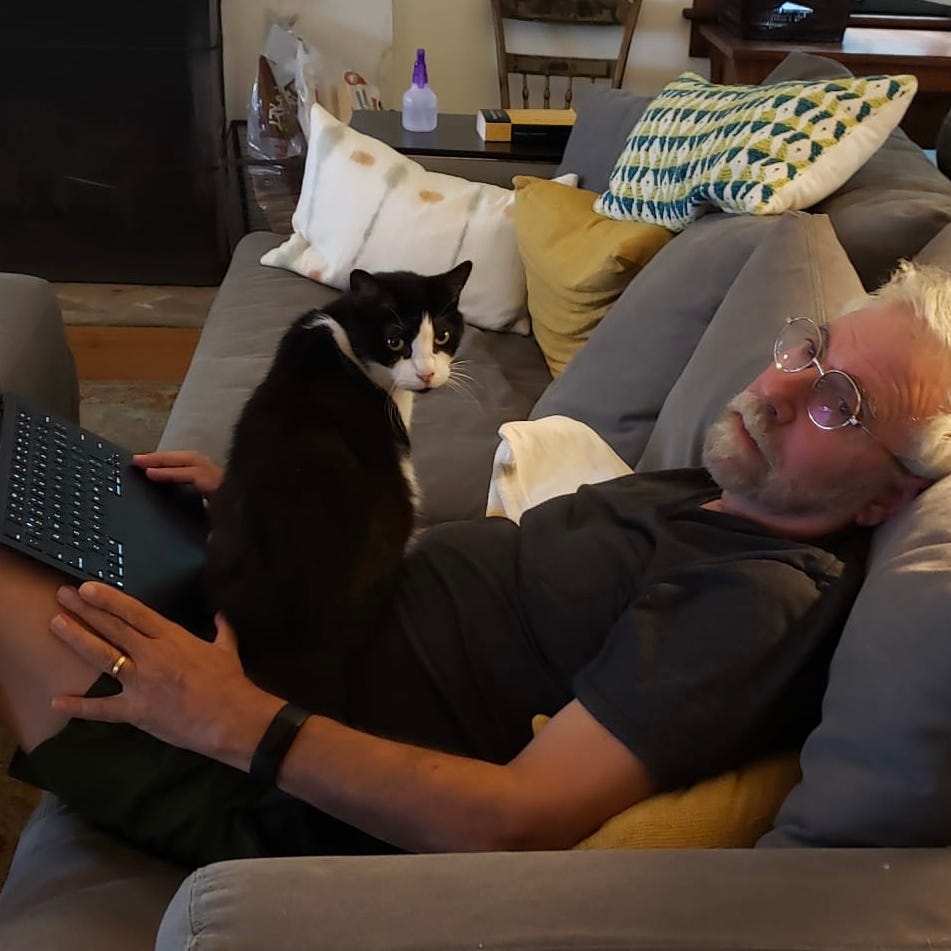

And I know lazy. Look in the dictionary and you’ll find my picture by the entry for lazy.

I don’t pay the guy who mows my lawn a cent, but he is me so it all works out.

FYI, I just fixed some typos and added a Musical Coda to this column:

https://youtu.be/PhxMTaD6B1k?si=YJN3hDIxyUaMN4wO